Why is Human Capital Management Different in Government?

Commercially-available Human Capital Management (HCM) and Human Resources Information System (HRIS) software rarely provide full capabilities for governments even though wage bills are often the largest expenditure in government organizations. Developed country public services expenditures range from 15% to 20% of GDP representing 10% to 35% of all employment according to the OECD. And, in developing countries the share of employment by the public sector is much higher.

That’s why the FreeBalance Accountability Suite™ includes Civil Service Management.

Issues Related to Civil Service Management

At around 20% of total country employment, and 15% of annual GDP in wage bills, salary budget scrutiny, risk management, and spending predictability is critical in government. Not to mention adapting pension mechanisms, adding to long-term entitlement contingent liabilities.

The government payroll is often source of corruption, with many governments paying thousands of “ghosts”. And, newly elected governments like to revisit civil service salary scales.

In a nutshell, human capital management is more complex in government because:

- Government payroll is subject to the legally binding budget and therefore budget management is more critical than in the private sector

- Payroll rules are more complex in government with many more hierarchies and layers

- Salary budget planning is far more important in government as this feeds directly into national budget planning

- Payment management is more complex in government, particularly in emerging economies

- Workforce management is more complex in government than the private sector

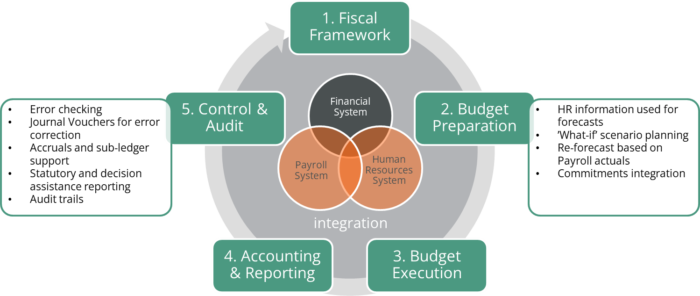

Government budget management and commitment controls make civil service management more complex than HCM in the private sector.

Budget Management in the Civil Service

How does “budget management” make government payroll and civil service expenses different from the private sector?

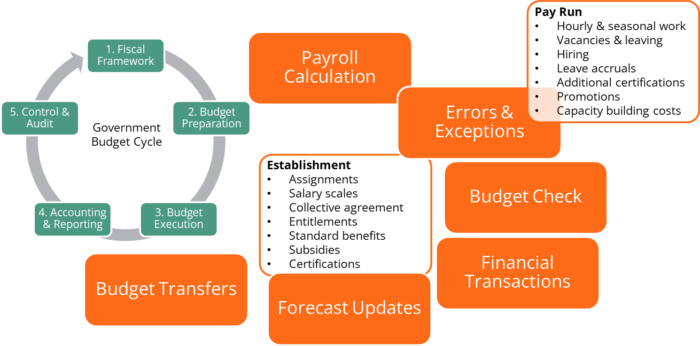

Each government pay run requires comparing payroll expenses versus budgets, often requiring budget adjustments.

- Budgets are the law: governments cannot exceed salary budgets, so payroll needs to be tracked and potential deficits forecast every pay period to identify spending adjustments and potential budget transfers

- Budgets include all public servant expenses: payroll, benefits, travel, training courses, subsidies – not just salaries

- Budgets relate to service delivery: saving money by reducing hours worked, training courses, and professional certifications reduces the quality of citizen services

- Budgets are about the future: covers pension entitlements for retired public servants

What is different about payroll rules in government compared to business?

- Government collective agreements generate tens of thousands of salary rules – and, these rules are subject to change every few years! (For example, it is estimated that the Government of Canada has over 80,000 pay rules – one of the reasons why the government-wide Oracle PeopleSoft implementation failed and continues to generate problems).

- Salary scale complexity includes political appointee, civilian, military, public security, education and health worker scales that are often different (this is further complicated by individual contractor payment scales)

- Public service subsidies are more complex with allowances, subsidies, benefits, and per diems (for example, some FreeBalance Civil Service Management governments have had ethnic subsidies to support equity, and subsidies to veterans, with subsidies with children and grandchildren of war veterans)

- Reform adds to complexity because Emerging Market and Developing Economy (EMDE) governments often have to reform salary scales and payment algorithms in response to currency fluctuations and economic shocks (that’s not to say that there isn’t any reform in advanced economies – there is)

- Pay periods differ: EMDE governments often have 13th and 14th month payroll payments or 1-off hardship or cost-of-living payments (In addition, many FreeBalance customers calculate pay based on percent of month worked rather than number of days and holidays in a month)

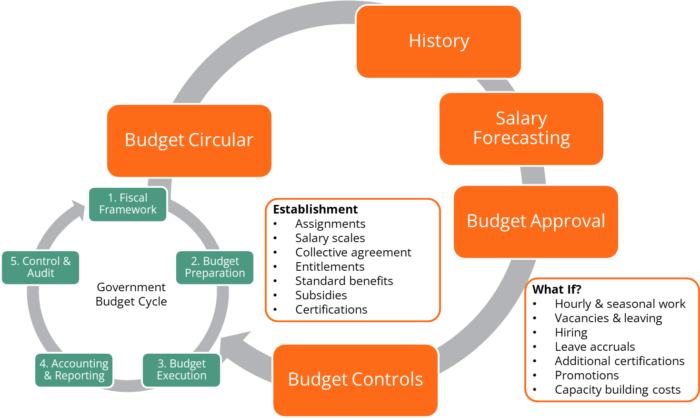

How is “budget planning” different in government than the private sector?

Governments engage in complex civil service “what if “planning consisting of payroll calculations & other public service expenses based on establishment rules.

All public financial functions, including payroll, are about budgets. Budgets have a purpose: to achieve desired outcomes. Salary planning has to take outcome factors into account, according to the IMF:

“Effective management of wage bill spending is needed to ensure that the desired public services are delivered in a cost-effective and fiscally sustainable manner. This requires adequate fiscal planning to ensure appropriate financing of the wage bill, competitive compensation to attract and retain skilled staff and incentivize performance, and the flexibility to adjust the level and composition of employment to respond efficiently to demographic and technological developments. Experience has shown that countries across all income levels have faced challenges in these areas.”

Budget scenarios to meet legal requirements and support credible budgeting are complex because scenarios include:

- Complex payroll, benefits, subsidies, and per diem rules

- Variable costs like overtime, hourly, and seasonal employment

- Potential vacancy rates, employment insurance payments, additional hiring, pay increases because of skills certification, and any annual general increases

In addition, EMDE governments are often unable to pay full salaries because of liquidity constraints putting countries in arrears and making budget scenarios that much more important.

Why is payment management more complex in government?

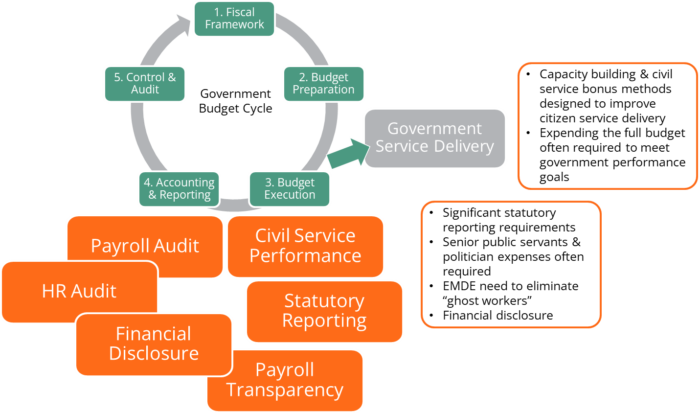

HR and payroll reporting, audit, and performance management is complex in government, because:

- Transparency: many governments require reporting on politician and senior public servant salaries and expenses (One FreeBalance customer also requires civil service financial disclosure as an anti-corruption mechanism)

- Payment methods: EMDEs, in particular, support payroll through cash, secure cheque printing, bank ‘pay agents’, EFTs to bank accounts, and EFTs to debit cards or mobile phones for public servants who do not have bank accounts (and, these payment methods differ based on regions, reform over time)

- Scale: large numbers of public servants combined with large numbers of payroll rules uses significant computing resources especially with single systems for a national government (For example, FreeBalance Civil Service Management generates pay for 320,000 public servants in Uganda)

- Exceptions: secondments, civil servant movement across governments, and data entry errors (when CSM systems are not rolled out across all government organizations) can generate large exception reports requiring significant amount of financial adjustments

How is workforce management more complex in government?

- Recruitment: hiring rules, certifications, approval, oversight, and public service exams exceeds private sector complexity (some FreeBalance CSM customers require hiring approval at the highest ministerial levels of government)

- Civil service data: material collected about public servants, the so-called “tombstone” data about addresses, qualifications, family, and employment history exceeds that collected in the private sector – and, this information needs to be retained for the life of the public servant for potential rehiring or those who left government, and for public pensions

- Movement: public servants tend to move to other government organizations more rapidly than in business adding to data complexity

- Talent management: governments engage in training, secondment, certification, and capacity building in more ways than businesses (Many FreeBalance CSM government customers support special public service capacity building organizations)

For more information on FreeBalance’s Civil Service Management solution, please get in touch.