Over at #fisc2016 @oliviermktg is taking our customers through a session on gov’t performance management pic.twitter.com/CSN02O1ETu

— FreeBalance (@freebalance) March 7, 2016

The FreeBalance International Steering Committee (FISC) started with a session on government performance management. Many think “government performance” is an oxymoron and it would be relatively easy to achieve if only they adopted private sector practices.

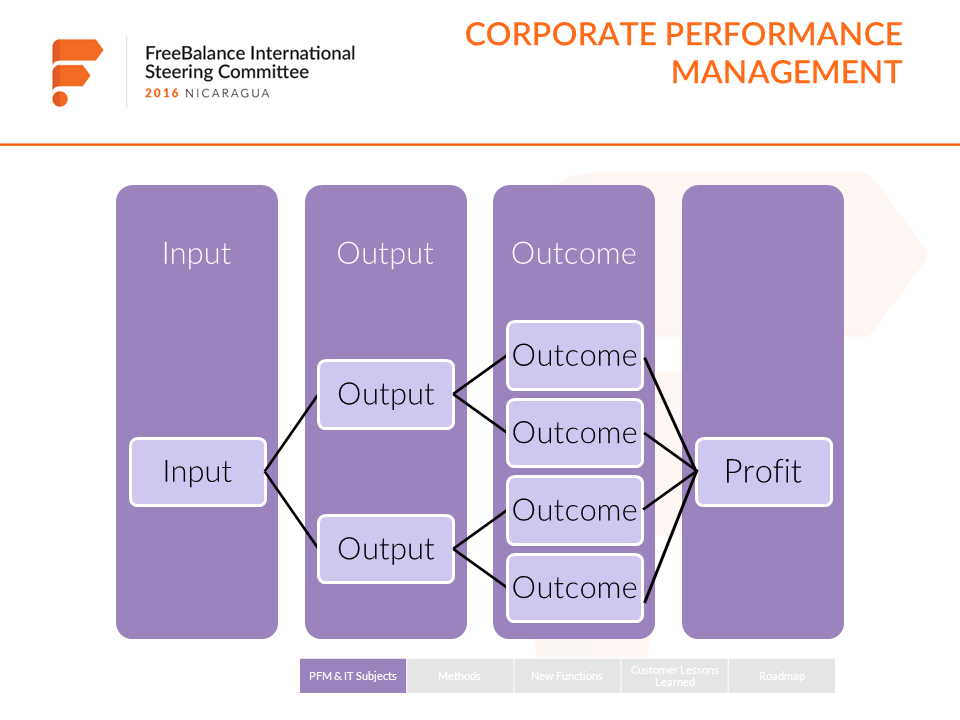

Corporate Performance Management vs. Government Performance Management

Corporate performance can be improved thanks to the bottom line of “profit”.

While government does not have the benefit of a “bottom line.”

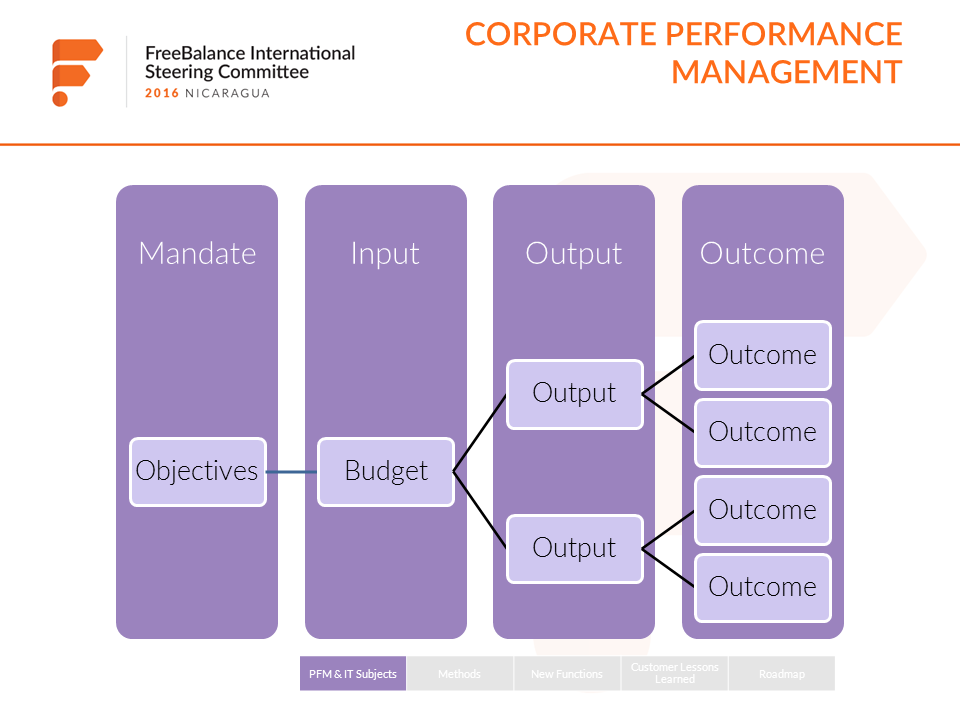

Challenges for government performance management include:

- Scope and Scale: Governments run more “lines of business” than any business

- Scope: Governments do not have any definitive bottom line like profit

- Scope: Budgets must be tied to performance because governments run commitment accounting

- Scale: Cascading complex objectives through MDAs and divisions to individual public servants is complex because there are so many staff members

![Performance Depth]() Complexity of Medium-Term Expenditure Frameworks

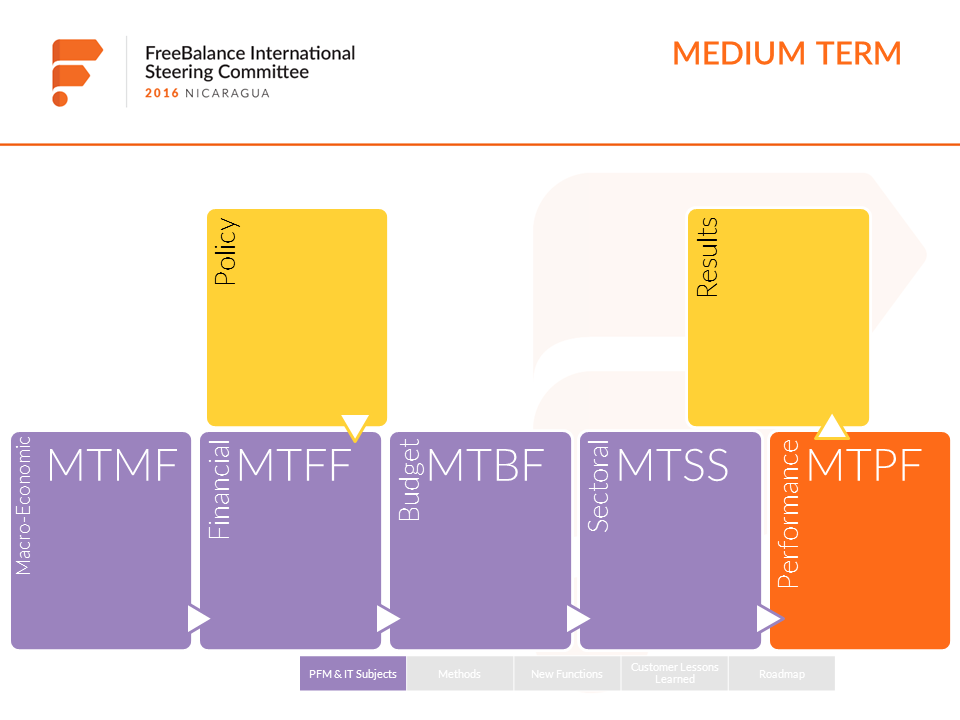

Complexity of Medium-Term Expenditure Frameworks

Multiple-year budget planning is considered a PFM “best practice.” Comprehensive MTEFs include macroeconomic, sectoral and performance frameworks. In principle, this enables planning based on national objectives. The plan characteristics are reflected in all spending and results.

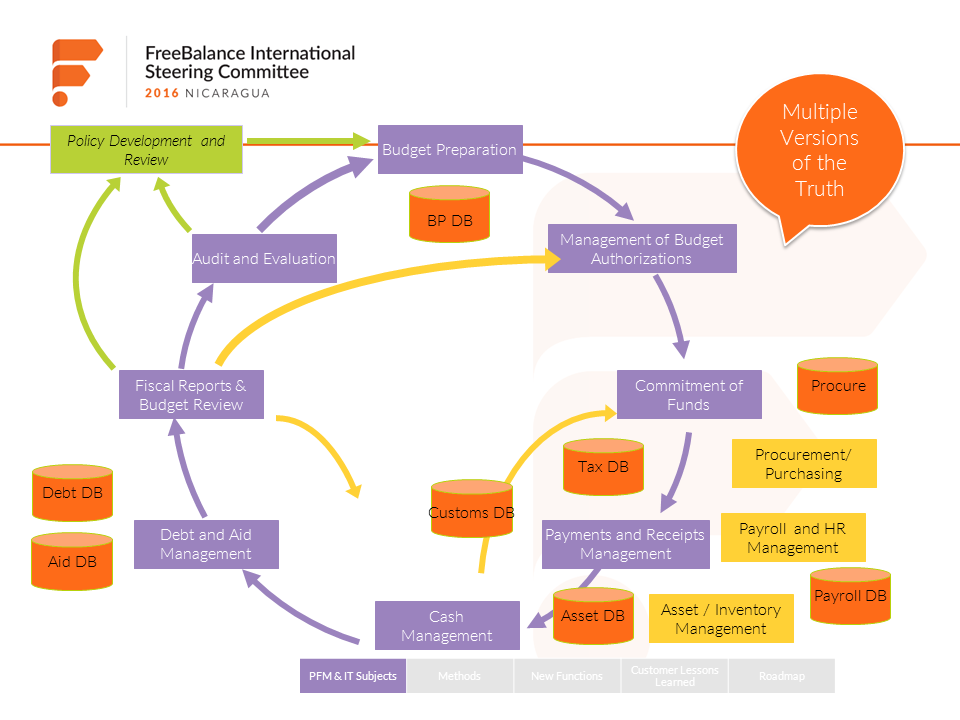

The difficulty that many governments face is cascading performance concepts through the revenue and expenditure lifecycles. These governments have acquired separate financial, human resources, tax administration and procurement systems. Different platforms. Different metadata. Many of these applications have no visibility or connection to controls or performance criteria.

The difficulty that many governments face is cascading performance concepts through the revenue and expenditure lifecycles. These governments have acquired separate financial, human resources, tax administration and procurement systems. Different platforms. Different metadata. Many of these applications have no visibility or connection to controls or performance criteria.  The topic shifted to the technology options for integration among systems to better manage and control for performance. This included the advantage of an underlying government platform that includes a service bus.

The topic shifted to the technology options for integration among systems to better manage and control for performance. This included the advantage of an underlying government platform that includes a service bus.

Complexity of Medium-Term Expenditure Frameworks

Complexity of Medium-Term Expenditure Frameworks