What is the Link Between Government Resource Planning (GRP) and the Sustainable Development Goals?

There is rising interest in improving public investment planning and public investment management. The management of long-term capital public expenditures is seen as a critical contribution to sustainable growth. Public investments are highlighted in the United Nations Sustainable Development Goal 9, Industries, Innovation, and Infrastructure. An example of how public investments are integral to sustainable development is highlighted by the World Green Building Council.

Numerous studies have shown the positive correlation between high quality public infrastructure and economic growth. Indeed, the International Monetary Fund (IMF) found that a 1% increase in infrastructure investment leads to a 1.2% increase in GDP growth within four years. There is no doubt that government infrastructure spending has one of the highest fiscal multipliers among all types of fiscal stimulus measures.

However, there is a significant infrastructure gap. An estimated $57 trillion in infrastructure investment would be required between now and 2030 just to keep up with projected global GDP growth. And that does not factor in the investment requirements needed to meet the Sustainable Development Goals.

How Could Public Investment Deliver the Sustainable Development Goals?

Discussions at the World Bank / IMF Spring Meetings revealed that the solution to the gap lies, at least partly, in improving the quality of infrastructure investments – particularly around governance. The IMF estimates that countries lose over one-third of potential benefits from infrastructure investment due to inefficiencies. Strong infrastructure governance can reduce more than half of these inefficiencies.

There is increasing focus on public investment quality with initiatives such as the Quality Infrastructure Investment (QII) Partnership led by the World Bank and the Government of Japan, and the IMF’s Public Investment Management Assessment (PIMA) Framework.

How Does Government Resource Planning (GRP) Improve Public Investment Management?

This rising interest in public investment management includes finding better automation and management solutions through the use of government budgeting software and enterprise software such as Government Resource Planning (GRP) systems such as the FreeBalance Accountability Suite™.

What is the Role of Software in Quality Public Investment Management?

FreeBalance‘s GRP software automates public investment planning, allocation, and implementation elements. Effective software supports scenario planning, investment prioritization, project management, and results management.

Why is Unified Software Needed for Quality Infrastructure Investments?

Many governments leverage enterprise software in a piecemeal fashion with bespoke software designed for the ministry or agency managing public investments. Manual information from budget preparation, financial management, procurement and asset management systems are entered into these systems. This is a recipe for disaster rather than quality public investment management.

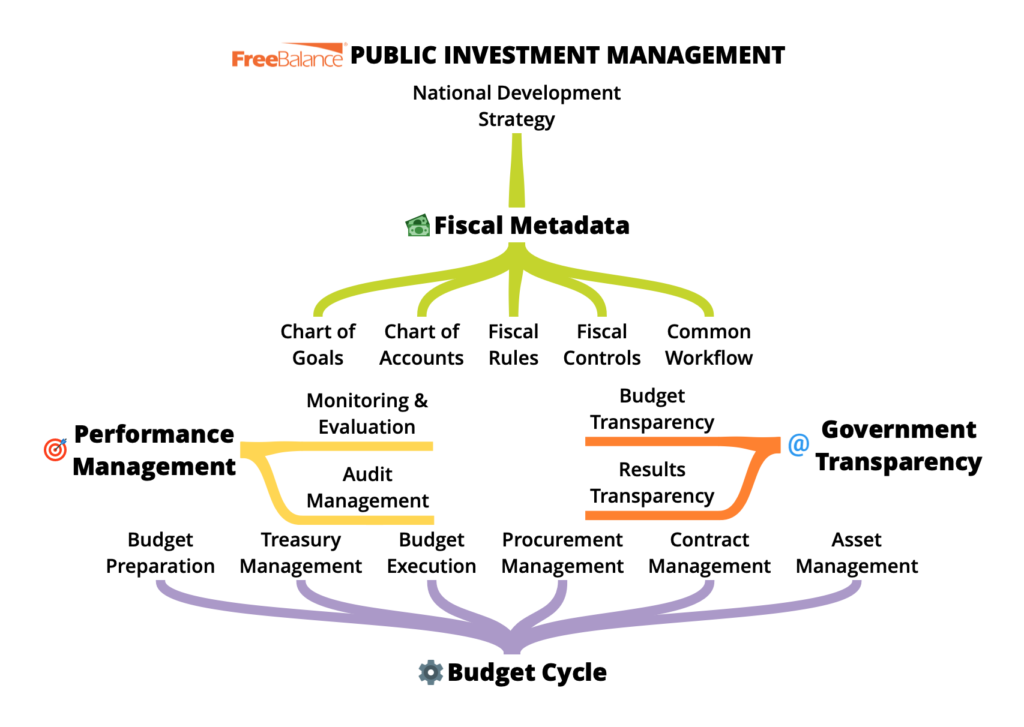

FreeBalance believes that a unified software solution such as the FreeBalance Accountability Suite™ is required for quality infrastructure investment. No public investment management system can be effective unless it provides a fully integrated, whole-of-government, governance and management solution.

Fiscal Metadata Integration ensures common budget classifications, performance and value-for-money structures, fiscal rules, controls and process compliance throughout the entire budget cycle.

Budget Cycle Integration with common fiscal metadata aligns budget preparation with execution with a multiple year view, while automating many stages.

Performance Management Integration with national development strategies across the budget cycle provides monitoring and evaluation and enables audit.

Government Transparency Integration across the budget cycle support budget and public investment results transparency including procurement.

How Does the FreeBalance Accountability Suite™ support Quality Public Investment Management?

FreeBalance’s GRP solution contributes to all 15 elements of the PIMA Framework as follows:

Fiscal Targets and Rules

- Budget Preparation Software such as (GPM) Government Performance Management

- Enforces capital budget planning rules through workflow tied to budget circulars and budget calendars

- Enforces fiscal rules in budget preparation

- Supports for medium-term frameworks to align with policy

- Supports public investment predictability through the use of cost drivers tied to established pricing

- Leverages scenario planning to identify effects of variables such as exchange rates or fuel prices on public investments

- Budget Execution Software such as (PFM) Public Financials Management and (PEM) Public Expenditure Management

- Enforces budget transfer rules to ensure adequate funds available for public investments

- Adjusts spending based on trends for re-forecasting

- Provides contract management solutions

- Tracks spending and physical execution for decision-makers

National and Sectoral Plans

- Core Software Metadata such as the FreeBalance Accountability Suite™

- Supports cross Ministerial planning in support of government and sectoral goals through program classifications

- Embeds government and sector classifications in program structures in Charts of Accounts

- Embeds performance management structures and desired outputs and outcomes in a Chart of Goals integrated with the Chart of Accounts

- Budget Preparation Software such as (GPM) Government Performance Management

- Ties performance and program structures to capital planning

- Adds narrative, documents, comments and approval mechanism to document how investment proposals meet government and sectoral goals

- Contract Management Software such as (PEM) Public Expenditure Management

- Track actual physical execution to track public investment outputs that update forecasts and cost drivers

- Performance Management Software such as (GPM) Government Performance Management

- Provides public investment monitoring scorecards and evaluate outputs and outcomes to improve public investment outcomes

- Results Transparency Software such as (GPM) Government Performance Management

- Publishes national development and sectoral strategies

- Enables searching through public investment projects based on the Chart of Accounts structure

Coordination Between Entities

- Core Software Metadata such as the FreeBalance Accountability Suite™

- Program management structures in Charts of Accounts enables coordination among government entities

- Support for financial consolidation through consolidated Chart of Accounts structures supports planning and execution coordination with local government

- Budget Preparation Software such as (GPM) Government Performance Management

- Provides certainty of budget support to line ministries and local governments through scenario planning and cost drivers

- Embeds rules for capital budget funding for subnational governments

- Treasury Management Software such as (GTM) Government Treasury Management

- Manages cash, debt, revenue and expenditure forecasting to improve funding certainty

- Treasury software at local and regional governments can impose fiscal rules to ensure sustainable levels of subnational borrowing

Project Appraisal

- Budget Preparation Software such as (GPM) Government Performance Management

- Multiple versions of capital budget submissions following the budget circular aligned with program structures integrate project documentation, comments, ratings, and decisions

- Embedded rules for public investment methodologies such as project analytical classifications, risk factors, and outcome expectations

- Performance Management Software such as (GPM) Government Performance Management

- Monitor public investment results to better inform future project selection

- Budget Execution Software such as (PFM) Public Financials Management

- Support for entering subnational government contingent liabilities in financial statements

Alternative Infrastructure Financing

- Budget Preparation Software such as (GPM) Government Performance Management

- Scenario planning for infrastructure investments can include different financing schemes including classic and alternative financing such as PPPs, user fees, green and blue bonds

- Identifies multiple year implications on revenue and expenditures for alternative financing to better manage long-term liabilities

- Provides the ability to support oversight of public corporation public investments

- Debt Management Software such as (GTM) Government Treasury Management

- Models alternative debt instruments

- Procurement Software such as (PEM) Public Expenditure Management

- Embeds PPPs in front and back office systems to improve budget and liability visibility

- Contract Management Software such as (PEM) Public Expenditure Management

- Ensures that revenue and expenditure flows for alternative financing adhere to contract rules

- Results Transparency Software such as (GPM) Government Performance Management

- Publishes project plans and actual physical execution including output and outcome information

- Supports public corporation output and outcome information

Multi-Year Budgeting

- Core Software Metadata such as the FreeBalance Accountability Suite™

- Supports for program management structures with programs, projects and activities in Charts of Accounts supports detailed public investment fiscal management

- Budget Preparation Software such as (GPM) Government Performance Management

- Supports for multiple year planning workflow including modelling infrastructure projects

- Provides project transparency within governments for investments by ministries, programs and projects

- Sets multi-year capital expenditure ceilings by ministry, sector, and program

- Budget Transparency Software such as (GPM) Government Performance Management

- Publishes budget plans, estimates and actual budget execution

Budget Comprehensiveness and Unity

- Core Software Metadata such as the FreeBalance Accountability Suite™

- Uses the fund source in the Chart of Accounts to track public investments financing

- Budget Planning Software such as (GPM) Government Performance Management

- Integrates development, capital, public investment, operating and salary budgets that are often different in many countries to provide decision-makers with the full budget picture

- Provides visibility for all sources of funding

- Supports reports, analysis, checklists, comments and other forms of documentation for project justification to support effective decision-making

- Budget Transparency Software such as (GPM) Government Performance Management

- Publishes budget plans

Budgeting for Investment

- Budget Planning Software such as (GPM) Government Performance Management

- Comprehensive infrastructure project planning ensures that all costs presented to legislature for approval

- Provides visibility for ongoing projects and forecasted completions to help prioritize project completion over new projects

- Budget Execution Software such as (PFM) Public Financials Management

- Supports multiple year commitments for infrastructure projects

- Prevents in-year transfers from capital to operating budgets

Maintenance Funding

- Core Software Metadata such as the FreeBalance Accountability Suite™

- Uses budget and accounting classifications within the Chart of Accounts to categorize maintenance funding linked to completed project classifications

- Budget Planning Software such as (GPM) Government Performance Management

- Uses maintenance cost drivers in budget planning based on established costs

- Categorizes major improvement on existing assets

- Budget Execution Software such as (PFM) Public Financials Management

- Tracks maintenance costs and inform changes to cost drivers

- Asset Management Software such as (PFM) Public Financials Management

- Embeds maintenance contracts associated with infrastructure assets

- Leverages lifespan rules to forecast needed maintenance based on type of infrastructure asset

Project Selection

- Budget Preparation Software such as (GPM) Government Performance Management

- Embeds standard criteria into public investment budget approvals

- Stores the pipeline of public investment proposals that have not yet been completed or been approved

- Performance Management Software such as (GPM) Government Performance Management

- Provides monitoring and evaluation material enabling project review to support infrastructure budget decisions

Procurement

- Core Software Metadata such as the FreeBalance Accountability Suite™

- Uses budget and accounting classifications linked to national development goals to inform criteria for value-for-money procurement

- Procurement Software such as (PEM) Public Expenditure Management

- Posting of tenders to e-procurement sites increases competition, improves value-for-money, and reduces costs

- Automatically links back-office commitments to e-procurement including embedding contract provisions based on public investment rules

- Automates procurement processes for compliance, ensuring that tenders are available for particular periods of time, and factors for encouraging local or small businesses are built in

- Automates procurement workflows including multiple stage procurement, clarifications, tender extensions, and disputes

Availability of Funding

- Treasury Management Software such as (GTM) Government Treasury Management

- Support for effective cash planning to plan and commit for capital projects and enable borrowing decisions

- Support for Treasury Single Account to maximize use of available cash and reduce borrowing

- Integrate donor funding in cash forecasting

- Budget Execution Software such as (PFM) Public Financials Management

- Support for warrants for monthly allocations based on cash availability to reduce need for cash rationing

- Integrate donor funded projects and donor conditionality into financial management

Portfolio Management and Oversight

- Contract Management Software such as (PEM) Public Expenditure Management

- Enables monitoring of capital project outlays based on contract milestones and payments

- Performance Management Software such as (GPM) Government Performance Management

- Integrates contract information with outputs and outcomes for monitoring and evaluation

- Budget Execution Software such as (PFM) Public Financials Management

- Enables budget re-allocations among investment projects based on results that are compliant to budget transfer rules

Management of Project Implementation

- Budget Execution Software such as (PFM) Public Financials Management

- Supports project accounting to support project management procedures

- Procurement Software such as (PEM) Public Expenditure Management

- Automatically embeds rules, procedures, and guidelines to tenders based on public investment categories

- Contract Management Software such as (PEM) Public Expenditure Management

- Applies project guidelines automatically based on contract types

- Audit Management Software such as (GPM) Government Performance Management

- Automates audit workflows

- Identifies audit candidates automatically

- Supports computer-aided audit mechanisms to full projects that used many vendors, across many years

Monitoring of Public Assets

- Asset Management Software such as (PFM) Public Financials Management

- Manages non-financial asset registries including capital assets and fixed assets

- Enables asset depreciation based on asset types

- Supports accrual accounting for assets in financial statements

For more information on how FreeBalance could help public investment management in your country, please get in touch.