Government financial management is about 3 things:

- Budgets

- Budgets

- Budgets

Planning for 15% to 20% of GDP

Yet many public sector organizations fail to adequately budget for salaries and public service costs like training and expenses. The government “wage bill” is often the largest category of government expenses in many government organizations. Developed country public services expenditures range from 15% to 20% of GDP representing 10% to 35% of all employment according to the OECD. In the OECD-countries, the average public sector employment rate was 21.3% in 2013. ILO data in Wikipedia shows that the share of employment by the public sector is higher in developing countries.

charted by Statista

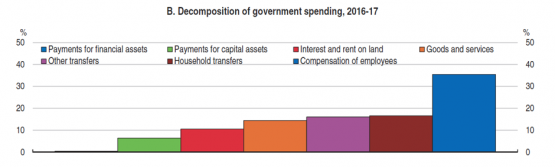

At around 20% of total country employment, and 15% of annual GDP in wage bills, salary budget scrutiny, risk management, and spending predictability is critical in government. This is particularly true when newly elected governments revisit civil service salary scales. Not to mention adapting pension mechanisms, adding to long-term entitlement contingent liabilities. For example, the South Africa public sector wage bill now swallows nearly 35% of the budget and 14% of GDP, representing the largest expenditure category, according to an analysis by Moneyweb:

The IMF has found a negative association between wage bill increases and the fiscal balance, and dire consequences from poor planning:

Wage bill spending can impact the fiscal balance and the composition of government expenditures. If not effectively integrated into budget planning, high or increasing wage bills can undermine fiscal planning. In addition, raising government wages or boosting hiring during cyclical upturns can exacerbate output fluctuations by further stimulating demand, hindering the stabilizing role of fiscal policy and ratcheting up public debt during the downturn as compensation increases are often hard to reverse. High compensation spending can also crowdout priority spending on public infrastructure and social protection, crucial for economic growth and poverty reduction.

Better planning can ensure that increases in the wage bill are appropriately financed. Otherwise increases in the wage bill can have unintended adverse implications for the fiscal balance requiring disruptive fiscal adjustment over the medium term to ensure fiscal sustainability according to the IMF. Nevertheless, an IMF survey found that many countries do not integrate decisions on wage increases into their budget planning process in a timely manner. Half of the advanced economies have ad hoc wage negotiations, with over a third making decisions on pay increases during the year without directly linking them to the budget.

Salary Planning is Much More than Money

All public financial functions, including payroll, are about budgets. Budgets have a purpose: to achieve desired outcomes. Salary planning has to take outcome factors into account, according to the IMF:

Effective management of wage bill spending is needed to ensure that the desired public services are delivered in a cost-effective and fiscally sustainable manner. This requires adequate fiscal planning to ensure appropriate financing of the wage bill, competitive compensation to attract and retain skilled staff and incentivize performance, and the flexibility to adjust the level and composition of employment to respond efficiently to demographic and technological developments. Experience has shown that countries across all income levels have faced challenges in these areas.

That’s why salary planning is more than calculating spending. Human resources budgeting is about enabling citizen services outcomes. This means training programs, knowledge sharing, secondments, performance and certification bonuses. Effective salary planning includes this investment in talent.

Software (Not) to the Rescue?

Government Resource Planning (GRP) software can help governments plan, budget, and control salary costs. Some public sector organizations elect to acquire Commercial-off-the-Shelf (COTS) human resources software. (Often called HCM for Human Capital Management, or HRIS for Human Resources Information Systems). These applications were originally developed for businesses. The key limitation of this class of software for government is budget awareness. The second major limitation is salary complexity.

Both of these limitations have been experienced by the Government of Canada using the ‘Phoenix Pay System‘, a customized version of PeopleSoft. As the Auditor General of Canada observed:

Public Services and Procurement Canada awarded a contract to International Business Machines CorporationIBM to help it design, customize, integrate, and implement new software to replace the government’s old pay system. The Department chose a PeopleSoft commercial pay software, which was to be customized to meet the government’s needs.

The need to highly customize PeopleSoft, and the failure to understand the implication of budget management, and integration with human resources has contributed to the cost of the system rising from the original C$310 million estimate to at least C$1.2 billion through 2019—with tens of millions more likely to be spent before its hoped for replacement comes on line in 2025. Much of this cost comes from revising hundreds of thousands of pay errors, where numerous public servants were not paid, many underpaid and some overpaid.

There are many factors that have led to this technology fail including sub-optimal procurement, governance, training and change management. These factors were built on the foundational assumption that government payroll requirements are very similar to large business payroll requirements. And, that any differences could be easily customized by sole-sourcing the leading private sector Enterprise Resource Planning (ERP) package for human resources. This idea of avoiding risk by choosing PeopleSoft was the first step in a modern IT Greek tragedy.

Budget Awareness: Budget Integration across the Budget Cycle

The ‘Phoenix Pay System‘ was designed to support payroll functions only. There does not appear to be any integrated method for budget preparation or budget controls. Every government financial transaction begins with a budget. Most COTS payroll software, originally designed for the private sector, lacks budget awareness. Government organizations often see payroll as a sub-ledger without hard budget controls. In other words, government pay people even when that may exceed budget. (Cash availability is a more likely limitation, particularly in developing countries.)

Why should government payroll software integrate with commitment accounting concepts of budgets, commitments and obligations?

- Salary and other public service costs are material to budget controls, so fluctuations can have a significant impact

- Government salaries fluctuate

- Governments can slow down infrastructure spending, salary obligations not so much

Salary planning and payroll management was decentralized in the Government of Canada prior to the implementation of the Phoenix Pay System. Salary Advisors in Canadian Federal organizations validated payroll every 2- week pay period. Many of these organizations used a FreeBalance product to do so. The “Performance Budgeting for Human Capital” product has been updated using the web-native FreeBalance Accountability Platform as “Civil Service Planning”. The important lesson is how this software supported the entire salary budget cycle:

Planning

- Integration of salary scales and civil service information from payroll systems, including PeopleSoft

- Scenario planning and forecasting, including ability to model new collective agreements

- Multiple year planning and historical information

- Budget controls for financial systems

Execution

- Change of budget forecast based on actual payroll and other civil service expenditures, such as changes to hourly work, seasonal work, overtime, vacancy rates, bonuses to enable spending changes

- Integration with financial systems for accrual accounting including leave taken, and new leave accrued

- Payroll error identification

It’s the last point that is particularly interesting given the errors experienced in the Phoenix Pay System. Data, as of May 30, 2018 indicates the following:

- 347,000 financial transactions “beyond the normal workload”

- 72,000 faulty transactions received in the month, with 97,000 processed (includes previous unresolved problems)

- 60% of non-collective bargaining transactions “processed within service standards”

Salary Complexity: Government Payroll more Complex than Private Sector

Governments hire more staff, who operate on far more “lines of business” than any private sector conglomerate. Developed countries, like Canada, have highly complex collective agreements. Large private sector union agreements are not as complicated. There are 27 collective agreements with 15 bargaining units, used in the Government of Canada. These include retroactive payroll calculations. There are about 80,000 different pay rules in the Canadian federal government that required about 200 customized additions to PeopleSoft. And, unions are constantly in negotiation meaning that collective agreements change over time.

There are additional complexities associated with government payroll planning and forecasting:

- Fiscal year often not the calendar year, as in Canada, United Kingdom, and the United States where benefits calculation change

- High variability in some government organizations around overtime, and seasonal changes

- Additional bonus structures, support for loans, complex group health & integration with performance incentives in many countries

- The political nature of public sector pay that results in changes in many countries, such as adding a bonus pay period

- Exchange rate, spending and revenue fluctuations that impact liquidity

- More movement of employees between organizations, and more salary fluctuations in government

Source: Our World in Data

Needed Functionality for 21st Century Government Salary Planning

Governments need budget-focused salary planning with the following functionality

- Full budget cycle support to handling planning and execution, including over multiple years

- Modelling complex public sector salary scales

- Collective agreement forecasting (grouping payroll rules, including salary scales, positions etc.)

- Liquidity integration for cash prediction

- Budget preparation integration to rationalize all spending

- Support for complex benefits

- Modelling seasonal changes, vacancies

- Scenario planning to anticipate the impact of large payroll variations

- Human Resources integration for staff changes like promotions, marital status, certifications, new employees, termination of employment, struck-off-strength, leave of absence, acting, secondment-in and out, transfer-in and out

- Payroll integration for re-forecasting

- Financials integration for accruals, sub-ledger functions, commitment controls

- Journal Vouchers to adjust for errors

- Global cost concepts to allow the calculation of forecasts by cost center, for cost items such as overtime, performance bonus or other allowances’.