Sustainable development drives political and economic discussion these days. As it should. As it did at the annual International Monetary Fund and World Bank Spring Meetings last week in Washington. I was fortunate to attend numerous sessions, augmented by watching webcast replays.

My takeaways on sustainable development, good governance, and government digital transformation have been collected in 3 blog entries. This includes summary takeaways followed by takeaways from each session. Webcast replays are embedded.

Context

- No country is expected to achieve the 17 Sustainable Development Goals (SDGs) by 2030

- Impediments to achieving SDGs are increasing thanks to food insecurity, trade tensions, migration, and climate change denial

- Rethinking traditional development approaches is critical to meet SDG aspirations

.@WorldBank shift from #poverty reduction to #growth, no shift to smaller interventions as recommended by Lant Pritchett of @HarvardCID https://t.co/xRYEHxGNcR via @TheEconomist

— Doug Hadden (@dalytics) April 12, 2019

Top 10 Sustainable Development Takeaways

Sessions at the Spring Meetings explored more about problems than solutions. That’s probably a good thing because innovation comes only through analyzing the problem space. Unfortunately, the solution space exploration focused primarily on improving governance, and trying to attract private financing. Good government governance results in improved revenue collection, better spending effectiveness, and increased trust. Trust helps to increase private financing. The question is really how to create the will to improve governance, considering the range of incentives to not do so. How can the SDGs motivate governance improvements when the financial crisis, Arab spring, and Millennium Development Goals only had incremental effects?

Numerous observers claimed that “one size doesn’t fit all”. You’d think that the narrative could have advanced beyond articulating the obvious.

It seemed to me that experts understand what necessary ingredients to meet SDGs. They don’t understand the recipe sequence of mixing ingredients, minimum and maximum amounts of ingredients, nor how to adjust the recipe to the country context.

- Governance is not a zero-sum game: sustainability problems do not respect boarders – good governance makes countries, regions, and the world more stable – it enables countries to focus on sustainability solutions many of which require regional and international cooperation

- No magic bullets: every financing instrument has risks, every governance practice improvement has monitoring and evaluation costs, and every sustainability intervention has uncertainty, so a risk-based approach to sustainability interventions is needed

- State credibility required: trust, transparency, accountability, anticorruption and good citizen services are preconditions for sustainable development to – however, this seems to be the answer to almost any development solution, so more holistic approaches are needed

- Digital can help: digital technologies for education, health, agriculture, transportation, and smart cities are part of the solution but experts lack analytical frameworks for government digital transformation because every digital solution has cyber-threats and negative externalities, so a risk-based approach to digital interventions is needed

- Persistence required: results from policy and practice changes take time , so medium-term approaches to planning, budgeting, revenue, and public investments are needed as are methods to measure and track performance in the complex public space

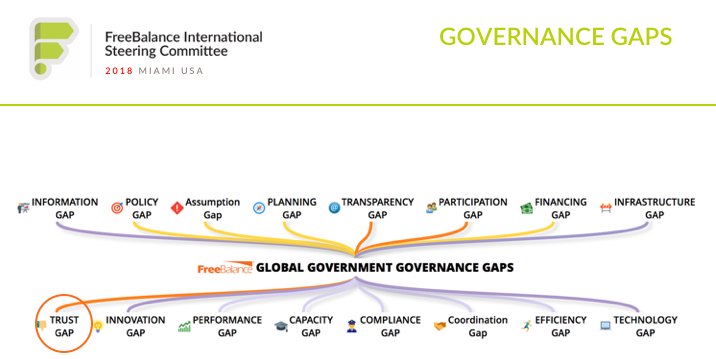

- Governance gaps impediments: recognition of financing and infrastructure gaps are insufficient to understand the inability to achieve SDGs, there is a need to understand the full scope of governance gaps to develop intervention roadmaps

- People-centred: SDGs are fundamentally about people where wellbeing should drive and simplify government priorities, where equity is a linchpin, resulting in improved trust in government and social cohesion creating an engagement environment of working with citizens to achieve national goals

- Follow the money: integration of SDGs from planning through spending to results can be achieved in core government financial management systems by integrating national objectives within the Chart of Accounts and using program budgeting across government silos

- Investment as portfolio: hard public investments like infrastructure, soft social public investments, and infrastructure maintenance operational budgets need to be integrated for an effective view for decision-makers, but should be seen as a portfolio when it comes to financing methods

- Public financial management helps: effective PFM systems supported by Government Resource Planning software provides cross-silo visibility across the budget cycle for policies, plans, scenarios, budgets, revenue, expenditures, and results

Public Financial Management Reforms as a Driver for Inequality

This session focused on tax equality in Uganda, although much of the discussion was around spending equality. Some takeaways:

- Need to align equitable tax collection with equitable spending & an eye on debt to sustain policies

- The medium term spending perspective, such as Medium Term Expenditure Frameworks, need to be extended to Medium Term Revenue Strategies

- Tax avoidance represents a key impediment to achieving equality in social public investments

- Tax policy showing the linkage between collected and program spending can improve the willingness to pay taxes, but earmarked spending based on revenue source may not be effective in the long run

Katherine Baer of @imfnews: gains from inclusive #tax management & #transparency can handle #inequality particularly at the top #PFM

— Doug Hadden (@dalytics) April 10, 2019

Katherine Baer of @imfnews: more progressive #tax can best handle #inequality but poorly managed in developing countries, #VAT can provide funding for equality & indirect taxes on consumption can be progressive #PFM

— Doug Hadden (@dalytics) April 10, 2019

.@JuliusMakunda discussing #VAT on water in #Uganda #PFM pic.twitter.com/aAJb2joYO9

— Doug Hadden (@dalytics) April 10, 2019

.@JuliusMakunda: how can governments operational medium term #PFM planning

— Doug Hadden (@dalytics) April 10, 2019

.@JuliusMakunda: public #infrastructure investment often doesn’t look at people, not increasing #poverty & often focused on huge projects when small local projects more effective #PFM

— Doug Hadden (@dalytics) April 10, 2019

.@JuliusMakunda: public investment management should also include social investment integrated with #infrastructure #PFM

— Doug Hadden (@dalytics) April 10, 2019

Steve Rozner of @usaid: when donors deliver #health services because local capacity low, local capacity won’t be built, so needs capacity building & #PFM practice changes such as poor #procurement & cash management pic.twitter.com/UCQVIG6NqM

— Doug Hadden (@dalytics) April 10, 2019

.@SaviorAfrica: seems to lots of rosy reports on #PFM reform in #Africa but not links to real outcomes

— Doug Hadden (@dalytics) April 10, 2019

Katherine Baer of @imfnews: #VAT gap in #Africa countries at 50 to 60% while #Latam has better compliance at 20-30%, huge funds available when #tax avoidance overcome #PFM

— Doug Hadden (@dalytics) April 10, 2019

.@SaviorAfrica: need to address #tax loopholes & effective spending from increased revenue #pfm

— Doug Hadden (@dalytics) April 10, 2019

.@JuliusMakunda: #tax policy should integrate with national objectives #PFM

— Doug Hadden (@dalytics) April 10, 2019

.@JuliusMakunda: much of new #tax revenue is to service #debt #PFM

— Doug Hadden (@dalytics) April 10, 2019

.@JuliusMakunda: #PFM #policy is about increasing local #productivity & production, otherwise money spent on foreign products

— Doug Hadden (@dalytics) April 10, 2019

Steve Rozner of @usaid: public investments when done well increase #productivity & incomes to reduce #poverty & #inequality #PFM

— Doug Hadden (@dalytics) April 10, 2019

Steve Rozner of @usaid: need to better understand the timelines of public investments to have outcomes #PFM

— Doug Hadden (@dalytics) April 10, 2019

Steve Rozner of @usaid: local #taxes have greatest impact on #inequality reduction, need to integrate #tax policy with central governments & fiscal transfers #PFM

— Doug Hadden (@dalytics) April 10, 2019

Katherine Baer of @imfnews: #VAT considered a regressive #tax, even exemptions for food & other necessary staples often benefits those who are better off #PFM

— Doug Hadden (@dalytics) April 10, 2019

Katherine Baer of @imfnews: introduction of #VAT has 1-time #inflation impact, but not after #PFM

— Doug Hadden (@dalytics) April 10, 2019

#corruption #tax compliance @imfnews report https://t.co/5LZujiO0x3 #imfmeetings

— Doug Hadden (@dalytics) April 10, 2019

.@JuliusMakunda: challenge for #tax policy, do funds collected by sector go to that sector, or should it go to the consolidated fund ? #PFM #IMFmeetings

— Doug Hadden (@dalytics) April 10, 2019

Steve Rozner of @usaid: case of #Georgia where #tax types reduced to 6 & experienced increase tax collections means that ring fencing special taxes might not be the answer #PFM

— Doug Hadden (@dalytics) April 10, 2019

Katherine Baer of @imfnews: once country like #Uganda starts to get oil revenue, often doesn’t look at non-revenue #tax policy #PFM #IMFmeetings

— Doug Hadden (@dalytics) April 10, 2019

Moses Kaggwa of @URAuganda: #PFM reform includes spending & revenue aligned to #politicaleconomy, was not coherent in past, now is on medium term & looking to ensure sector spending aligned to #gender #equality & #poverty reduction pic.twitter.com/vsUIMph7fr

— Doug Hadden (@dalytics) April 10, 2019

Moses Kaggwa of @URAuganda expects spending increases for #healthcare in #Uganda #PFM

— Doug Hadden (@dalytics) April 10, 2019

Moses Kaggwa of @URAuganda: looking to share #tax information on #multinationals with other jurisdictions & increase #audit capacity #PFM

— Doug Hadden (@dalytics) April 10, 2019

Moses Kaggwa of @URAuganda: considerable political pressure to provide #tax relief to attract business, but better to raise the money & spend it on making it easier for #doingbusiness #PFM #IMFmeetings

— Doug Hadden (@dalytics) April 10, 2019

Moses Kaggwa of @URAuganda: often #budgets using earmarking often runs ahead of priorities, where people design programs to spend the money, often not effective #PFM #IMFmeetings

— Doug Hadden (@dalytics) April 10, 2019

Katherine Baer of @imfnews: tapping into regional #PFM expertise may be as effective, or more, as working with international experts #IMFmeetings

— Doug Hadden (@dalytics) April 10, 2019

Steve Rozner of @usaid: budget #earmarks often reduces #transparency & tends to get established in budgets long after need resolved #PFM #IMFmeetings

— Doug Hadden (@dalytics) April 10, 2019

Sustainable Infrastructure: Aligning with Rights and SDGs

The financing gap was the major theme of this session. The IMF found that there is a financing gap of 0.3% of GDP in low-income countries to meet the Sustainable Development Goals (SDGs) by 2030. Meanwhile, McKinsey has identified an annual $3.3T infrastructure gap to meet current growth rates to 2030.

Some takeaways:

- There’s a lot of confusion about where to start to overcome the financing and infrastructure gaps, although some of the governance gaps were mentioned like government performance, transparency and trust

- There are no magic bullets for financing, with many examples of failed Public Private Partnerships

- The notions of sustainable and quality infrastructure investments were discussed, but without any shared understanding of the concepts

- The need to integrate government objectives, such as national development plans, with infrastructure project value-for-money design ..

.@MattiKohonen: packed room shows the importance of sustainable #sustainability #imfmeetings pic.twitter.com/i9OTsf5JQR

— Doug Hadden (@dalytics) April 10, 2019

.@MotokoTweets described quality infrastructure #geopolitical context, especially in #Asia between #China #Japan #sustainability #imfmeetings pic.twitter.com/HLiupowz2s

— Doug Hadden (@dalytics) April 10, 2019

#QII Quality Infrastructure Investment overview https://t.co/PyKRbMWTTm #Sustainability #IMFMeetings pic.twitter.com/Khocpxk0Wy

— Doug Hadden (@dalytics) April 10, 2019

.@MotokoTweets: definition of quality #infrastructure differs among observers #QII #sustainability #imfmeetings

— Doug Hadden (@dalytics) April 10, 2019

.@MotokoTweets introduces 5 elements of quality #infrastructure as defined by #Japan #QII #sustainability #imfmeetings pic.twitter.com/pqxhK7Zexb

— Doug Hadden (@dalytics) April 10, 2019

.@MotokoTweets introduces quality #infrastructure work, standards #QII #sustainability #imfmeetings pic.twitter.com/dYQ6GQBQ9e

— Doug Hadden (@dalytics) April 10, 2019

. @AmaleeAmin of @the_IDB shows extent of needed sustainable #infrastructure investment #sustainabilty #IMFMeetings pic.twitter.com/tZi0oSHQyO

— Doug Hadden (@dalytics) April 10, 2019

.@AmaleeAmin: on timeline & @the_IDB definition of sustainable #infrastructure #sustainability #imfmeetings pic.twitter.com/QSFsYQWKNj

— Doug Hadden (@dalytics) April 10, 2019

.@the_IDB study referenced by @AmaleeAmin #sustainability #imfmeetings https://t.co/XrJOPsitcp

— Doug Hadden (@dalytics) April 10, 2019

.@AmaleeAmin: has been lots of work, tools for #infrastructure preparation & design but not for upstream work for #procure & public private partnerships decisions, financing #PPPs #sustainability #imfmeetings pic.twitter.com/DRU1OUUGDC

— Doug Hadden (@dalytics) April 10, 2019

.@AmaleeAmin introduces upcoming @the_IDB attributes & framework for sustainable #infrastructure #sustainability #imfmeetings pic.twitter.com/Kh38qPxsCU

— Doug Hadden (@dalytics) April 10, 2019

.@ceciliagonard of @eurodad talks #infrastructure #financinggap & billions to trillions agenda via reform & de-risking #sustainability #imfmeetings pic.twitter.com/9byBp6xJh2

— Doug Hadden (@dalytics) April 10, 2019

.@ceciliagonard: growing literature on #risk of public private partnerships #PPPs #3Ps #sustainability #imfmeetings

— Doug Hadden (@dalytics) April 10, 2019

.@ceciliagonard introduces public private partnerships global campaign manifesto #PPPs #3Ps #sustainability #imfmeetings https://t.co/Y9n6bPVCgb pic.twitter.com/IoTHLFatUO

— Doug Hadden (@dalytics) April 10, 2019

David Cruz of @ambienteysoc describes public private partnerships #fail in #Colombia from #odebrecht #corruption scandal #sustainability #IMFMeetings pic.twitter.com/55ONUlGCsT

— Doug Hadden (@dalytics) April 10, 2019

David Cruz of @ambienteysoc: need to consider financial, social & #environmental costs related to public private partnerships #PPPs #3Ps #sustainability #imfmeetings

— Doug Hadden (@dalytics) April 10, 2019

Clive Harris: domestic #resourcemobilization remains largest source for #infrastructure finance #sustainability #IMFMeetings

— Doug Hadden (@dalytics) April 10, 2019

Clive Harris points to #PPPs #3Ps resource center https://t.co/rcHKvgwG8D #sustainability #IMFMeetings

— Doug Hadden (@dalytics) April 10, 2019

Clive Harris: lots of talk about #financing gap for #infrastructure– seems to more of a #governance gap, #transparency declines across the #procurement cycle https://t.co/ir450xEjx4 #sustainability #IMFMeetings

— Doug Hadden (@dalytics) April 10, 2019

The Economic and Social Case for Human Capital Investments

Big infrastructure projects are dramatic. Yet, it’s social public investments that have the most dramatic long-term impact. Some takeaways:

- The Human Capital Project found that 2/3 of global capital is human capital demonstrating the importance of thinking differently about social investments

- Equality is a key component to building human capital for sustainable growth, the world is estimated to be $164T poorer because of gender inequality

- Wellbeing makes policy people-centric, enabling governments to focus on evidence for spending decisions (as we learned earlier this year at the H-20)

- Developed countries like New Zealand have created wellbeing budgets to address inequities

- Wellbeing and human capital success can only be achieved through government-wide approaches tied to national goals – silos will not work

- Human capital development is like an annuity that builds value over time, so a long-term horizon is needed that can be impeded by short-term political pressures

- Wellbeing requires measuring outcomes rather than budget inputs making the performance structure more complex but more rewarding

Breaking barriers to build human capital:

-Communities/ individuals need to be engaged

-Gov’t agencies should not operate in silos

-We need to prepare for the unknown, in a world that’s rapidly changing. #InvestinPeople https://t.co/eqT4ginMmu— World Bank Live (@WorldBankLive) April 10, 2019

1/3 #HumanCapital is the largest component of global wealth, accounting for 70% of wealth in rich countries, but only 41% in poorer ones. If countries want to be wealthy tomorrow, they need to #InvestInPeople today. pic.twitter.com/DPmVs5x2uL

— Kristalina Georgieva (@KGeorgieva) April 10, 2019

Incredible panel featuring @KGeorgieva @BMLopezB @grantrobertson1 @BizFleury who discussed: a well-being budget, environmental capital and the responsibility of governments to help their populations continue to develop skills @WorldBank @IMFNews #investinpeople #YDCinDC #SMCS19 pic.twitter.com/RtNsls2XLX

— Shannon Hazlett (@ShannHazlett) April 10, 2019

Building Human Capital in Africa: The Future of a Generation

.@JulieGichuru: #Africa is youngest continent, great #InvestInPeople #AFRICACan success stories #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

.@HafezGhanem_WB: 43% of Africans younger than 15, children lack access to #education #healthcare & food #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

.@HafezGhanem_WB: World Bank to ramp up #education spending my 30% by 2021 in #Africa #fragilestates #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

#InvestInPeople “We are committed to making the [African Human Capital] project work, making every child & every person count in Africa.” – Hafez Ghanen, Vice President, Africahttps://t.co/Q9Fwsn8ucT#IMFWeek2019 #SmartProsperity #SmartGovernment pic.twitter.com/jJn4Hyal0L

— FreeBalance (@freebalance) April 11, 2019

.@HafezGhanem_WB: #policy reforms for human capital advocated by World Bank for #healthy#education #socialprotection #InvestInPeople investment examples in #Angola #DRC #Mozambique #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

His Majesty King Letsie III: building human development should be at centre of #development because of the catalytic effect #InvestInPeople #AFRICACan #WBGmeetings pic.twitter.com/OBRJJu20uh

— Doug Hadden (@dalytics) April 11, 2019

“I ask that our Ministers of Finance to lend their weight to our cause to build our human capital… For every dollar invested in nutrition, there is a future economic return of thirty dollars.” – His Majesty King Letsie III, King of the Kingdom of Lesotho #InvestInPeople pic.twitter.com/1U4ve2dVOi

— FreeBalance (@freebalance) April 11, 2019

His Majesty King Letsie III: need to channel #youth as major resource, need to leverage #demographicdividend, governments need to make smarter #development decisions #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

His Majesty King Letsie III: positive correlation between #nutrition & economic #development #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

His Majesty King Letsie III: #gdp per worker in #Africa could increase 2.5 times #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

His Majesty King Letsie III: sub Saharan #Africa has highest incidences of #stunting with long-term negative effects in #health #income & #socialmobility – effects extend to ability to handle #4IR #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

His Majesty King Letsie III: #Africa loses 11% #GDP through #malnutrition & #stunting #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

His Majesty King Letsie III: #Lesotho now spends 10% of #GDP on #education, World Bank funded #equity & teacher capacity building #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

His Majesty King Letsie III: unwavering political commitment from #Africa leaders required to meet #InvestInPeople #AFRICACan objectives, requires large scale sustained interventions across many sectors to succeed #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

.@JulieGichuru introduces #Blog4Dev designed for #socialmedia #development conversations #InvestInPeople #AFRICACan #WBGMeetings pic.twitter.com/akRKojTpQa

— Doug Hadden (@dalytics) April 11, 2019

Effects of computer usage for #education highlighted in #Blog4Dev keynote, education beyond reading to doing #InvestInPeople #AFRICACan #WBGMeetings pic.twitter.com/BqCXcDh7Ok

— Doug Hadden (@dalytics) April 11, 2019

#blogfordev “Our plea to you: teach every young person to use a computer, computer literacy or any literacy, encourage us to innovate & take risks.” #AfricaCanhttps://t.co/pIGEiIHj8p #InvestInPeople #IMFWeek2019 #SmartProsperity #SmartGovernment pic.twitter.com/2qEvKJ2G8i

— FreeBalance (@freebalance) April 11, 2019

.@EmiThePoet at 21 knew about how to start a revolution but not what to do after, we’re more accustomed to feel of Molotov cocktails than human touch #InvestInPeople #AFRICACan #WBGmeetings pic.twitter.com/rpXDHilcop

— Doug Hadden (@dalytics) April 11, 2019

.@EmiThePoet: children pay highest cost in #conflict #youth #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

.@MusoniPaula: #Rwanda had poor governance before #genocide excluded one group from #education, after country had lost people through death & #migration & educational infrastructure destroyed #InvestInPeople #AFRICACan #WBGmeetings pic.twitter.com/t5RDsKiDOy

— Doug Hadden (@dalytics) April 11, 2019

.@MusoniPaula: special attention needed for people with disabilities because of injuries from conflict #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

.@MusoniPaula: lesson learned is need for inclusive human capital investment #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

Dalitso Kabambe, Governor, Reserve Bank of Malawi: need for #education & skills development #genderequity because of huge untapped labour force #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

Aïchatou Boulama Kané, Niger Minister of Planning talks about social investment & concrete results for #education & dealing with cultural context #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

Ruth Kagia #Kenya Office of President: human capital success 1. shared & sustained vision #Vision2030, 2. Put money where mouth, 3. Focus on low cost high impact interventions, 4. Strong leadership who sees #education as gateway for growth #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

.@MusoniPaula: #health #technologyleapfrog started with #innovation funding, adding tech in government helps to diffuse benefits #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

.@MusoniPaula: digital ambassadors program in #Rwanda to help people use tech for government services while focused #InvestInPeople #AFRICACan #WBGmeetings

— Doug Hadden (@dalytics) April 11, 2019

Driving Private Investment to Fragile Settings

Private sector investment is seen as a solution to the financing gap. Some takeaways:

- Private investment needs “de-risking” through financing insurance from development partners, improved governance to increase trust, and improved regulatory environment for doing business

- There doesn’t appear to be a significant uptake of the approach of combining private and public funding

- The impact of large cities investment in sustainability is significant, but was not discussed – that’s surprising given that the majority of people live in urban centres and cities are leading much of the narrative

.@DavidMalpassWBG opens up #InvestingHSF session #WBGmeetings pic.twitter.com/LAUUEFyrSW

— Doug Hadden (@dalytics) April 11, 2019

Only 1% of the world’s Foriegn Direct Investment goes to fragile states. It was encouraging to hear @WorldBank’s new President @DavidMalpassWBG talk about creating enabling environments to mobilize private FDI to countrys that need it most. #investingFCS #SpringMeetings pic.twitter.com/klDUTyccva

— Shamini Selvaratnam (@shaminis) April 11, 2019

.@khonda: it’s an exciting time to mobilize private investment that can be 3 times #ODA regular donor funding #WBGmeetings #InvestingHSF pic.twitter.com/MbtWSXdBKh

— Doug Hadden (@dalytics) April 11, 2019

.@khonda: @MIGA focuses on derisking investment in #fragilestates #WBGmeetings #InvestingHSF

— Doug Hadden (@dalytics) April 11, 2019

Jacob Jusu Saffa, #SierraLeone Finance Minister: government investment insufficient to meet #SDGs, need for private investment that also generates employment #WBGmeetings #InvestingFCS pic.twitter.com/4RVdBnadYT

— Doug Hadden (@dalytics) April 11, 2019

Jacob Jusu Saffa: #fragilestates have poor institutions & #infrastructure, seen as high risk for investors, democratic stability through multiple elections helps to increase confidence #WBGmeetings #InvestingFCS

— Doug Hadden (@dalytics) April 11, 2019

.@MaseRikweda speaks to investment in #Afghanistan in raisin sector through @MIGA assistance #WBGmeetings #InvestingFCS pic.twitter.com/IM2mQ9E7VC

— Doug Hadden (@dalytics) April 11, 2019

After years of war, Afghanistan is looking make a comeback as one of the world’s biggest exporters of raisins 🍇.

▶️ https://t.co/Nxfa8AFcnd #IFCmarkets #InvestingFCS pic.twitter.com/adSUu2Nf74— IFC (@IFC_org) April 10, 2019

SDGs in Action: Integrating the SDGs in National Budgets

This discussion seemed to lack a nexus or central concept. It was somewhat unclear how the participants expected SDGs integration throughout the entire government budget cycle. Some takeaways:

- Lack of information for decision-makers on how much governments are spending on SDGs, and there is a risk that traditional spending will be counted as part of the SDGs commitment

- There will be no significant increase in private investment in SDGs without trust, there is a good governance dividend

- Improvements come from measuring, so SDGs should be embedded in government Charts of Accounts tracking budget plans, actual revenue and spending, and comparing outcomes with plans

The #2030Agenda is an opportunity to transform our world. Take a look at how countries can use their national budgets to finance a more sustainable and equitable tomorrow. https://t.co/QcgHdk2XFe#FinancingSDGs #WBG4SDGs

— UNDP Asia-Pacific (@UNDPasiapac) April 11, 2019

Mahmoud Mohieldin: need to look at #SDGs funding & technical challenges at national to local level #WBG4SDGs #WBGmeetings pic.twitter.com/00YdipRbpR

— Doug Hadden (@dalytics) April 12, 2019

.@AminaJMohammed: #SDGs weren’t created in the bowels of the UN, sees them setting agendas but progress limited, needs domestic #budget priorities in governments, haven’t articulated how to do that #WBG4SDGs #WBGmeetings pic.twitter.com/QnhOac0b9U

— Doug Hadden (@dalytics) April 12, 2019

.@erbdsuma: we’re off track on #SDGs & only 11 years to go, private sector needs long term regulatory environment, gives example of largest #solarpark under construction in #Egypt #WBG4SDGs #WBGmeetings pic.twitter.com/rgHEbqcSuA

— Doug Hadden (@dalytics) April 12, 2019

Mahmoud Mohieldin: need to look at #SDGs funding & technical challenges at national to local level #WBG4SDGs #WBGmeetings pic.twitter.com/00YdipRbpR

— Doug Hadden (@dalytics) April 12, 2019

.@KGeorgieva: #WBG4SDGs is the most important priorities, ‘as we sit in this beautiful place’ won’t achieve #SDG1 unless we change our approach #WBGmeetings pic.twitter.com/dDe4oMODsY

— Doug Hadden (@dalytics) April 12, 2019

.@KGeorgieva: World Bank in best financial position, highest increase ever but won’t help unless government #policy improves & leverages #transparency – hopes that #Africa will technology leapfrog using private sector help #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

.@smindrawatii: #Indonesia has created an #islamicfinance product #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

Sri Mulyani shared Indonesia’s blended finance initiative called SDG Indonesia One: Gov’t money + funds from state-owned enterprise + investment from philanthropies + private investment. #WBG4SDGs #Doct4Devt #SDGs @wbg2030

— Jecel Censoro (@JecelC) April 12, 2019

Sri Mulyani: “To put on the SDGs forward, we need to mainstream it in the country development plan. Putting into account SDG in the planning and budgeting design. From the government budget design, SDG can be internalized or built starting from revenue generation”. #WBG4SDGs

— Jecel Censoro (@JecelC) April 12, 2019

.@smindrawatii: #SDGs can be built into government revenue, spending & financing from #tax incentives to business, looking at how to leverage #fiscalrule for #education & #health to achieve goals #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

.@PennyMordaunt: UK putting #SDGs into departmental goals, govt has #impactinvestment expertise that might help reduce funding gap, if can leverage 1% of city of London investment, can double ODA to #Africa #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

@AminaJMohammed : “We have a lot of the value proposition is prevention disaster from and transition to development that is more inclusive, that works for the people. #WBG4SDGs #Doc4Devt #GlobalGoals

— Jecel Censoro (@JecelC) April 12, 2019

.@reinabuijs: cooperation has improved through #SDGs as a common language, #netherlands needs to reduce #carbonfootprint & improve #genderequity #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

@blanchardCanada: There will be no digitalization without access to energy. #WBG4SDGs #WBGMeetings

— WBG: 2030 Agenda (@wbg2030) April 12, 2019

23B has been raised by WBG from private sectors for the SDGs according to Mahmoud Mohieldin. #WBG4SDGs #PhDiary2019 #Doc4Devt

— Jecel Censoro (@JecelC) April 12, 2019

#SDGs in action: @ebrdsuma we are doing #EBRDmore financing for development than ever before. Take action now! It’s important! #SDGs #WBGMeetings #WBG4SDGs https://t.co/93wc3wriHC pic.twitter.com/hi93uM1YYO

— The EBRD (@EBRD) April 12, 2019

Vitor Gaspar: good governance in #Rwanda has helped increase revenue by 6% of #GDP #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

Victor Gaspar of @IMFNews: Rwanda is a good example of a country that worked substantially on governance. They collected 6 percentages of GDP by themselves. Complementaries with the private sector are still missing and have to be explored #WBGMeetings #SDGs #WBG4SDGs pic.twitter.com/hUncTbQtVP

— WBG: 2030 Agenda (@wbg2030) April 12, 2019

.@DrSahar_Nasr: need to mainstream #gender in national #budgets #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

Ichiro Hara: society 5.0 for #SDGs via new tech https://t.co/i21qx0Ax5Y #WBG4SDGs #WBGmeetings https://t.co/970a3TCNxS

— Doug Hadden (@dalytics) April 12, 2019

Improving tax systems is necessary in many countries to achieve the #SDGs. More domestic resources are needed to fight #inequalities and #poverty #By2030. A few ideas on how it can be done here https://t.co/rCuy2zwNQ8 #FinancingSDGs #WBG4SDGs pic.twitter.com/0wccvX5nmj

— UNDP SDGs (@UNDP_SDGs) April 12, 2019

.@AminaJMohammed: need to deepen partnerships to get billions to trillions by mobilizing private sector investment #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

.@AminaJMohammed on SDGs stocktake to date: ‘We’ve heard talk about greening the economy, but not at the urgency or scale we need.’#WBG4SDGs #ClimateAction

— Jon Sward (@JonSward) April 12, 2019

@Lagarde: IMF is expanding work on governance and corruption because of the costs associated with corruption #WBGMeetings #SDGs #WBG4SDGs

— WBG: 2030 Agenda (@wbg2030) April 12, 2019

.@Lagard: on #SDGs, governments don’t so much have to spend more to spending better, with #transparency as lynchpin to encourage private sector investment #WBG4SDGs #WBGmeetings

— Doug Hadden (@dalytics) April 12, 2019

Surprised to hear @SigridKaag say #Netherlands needs to work on #SDG5: gender. #WBG4SDGs #WBGMeetings

— WordNirvana. (@WordNirvana) April 12, 2019

Gwen Hines @gwenhinesSave : Let’s follow the money to accelerate impact and see what it’s achieving. The Human Capital Index show us that investments in #children and #youth are of paramount importance. #WBG4SDGs #WBGMeetings #SDGs pic.twitter.com/kBopnMoOJ4

— WBG: 2030 Agenda (@wbg2030) April 12, 2019

State of the Africa Region: The Role of Regional Cooperation in Tackling

State fragility and reducing growth in Africa were the main concerns for this session. Takeaways:

- Governance isn’t a zero-sum game because fragility and the causes of fragility cross borders

- State credibility is the primary factor to overcome state fragility because the State is often not present or capable of citizen services

- Gender equity and opportunities for critical for economic growth yet run up against cultural norms

- Digital can help growth by improving access to needed information and education

Allowing the young people of #Africa to access #technology has the possibility to address many of the factors of #conflict and instability: loss of hope of #youth, lack of services, sentiments of exclusion, corruption, and access to services. – @HafezGhanem_WB #AfricaSOR pic.twitter.com/uoxHZgKhCs

— vunorocharlene (@vunorocharlene1) April 13, 2019

.@HafezGhanem_WB: Economic growth is estimated to be 2.3% in 2018 – which continues to be below population growth. This is worrisome. https://t.co/nmypVzcMR4 #AfricaSOR pic.twitter.com/vkHt4rKeJS

— World Bank Africa (@WorldBankAfrica) April 13, 2019

.@HafezGhanem_WB: % of #poverty #Africa has gone down, but net number of poor has gone up #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB: We do have countries such as #Senegal, #CotedIvoire, #Ethiopia, who do have strong economic growth, but larger economies and oil exporting countries are bringing the average down. https://t.co/nmypVzcMR4 #AfricaSOR

— World Bank Africa (@WorldBankAfrica) April 13, 2019

.@HafezGhanem_WB: more than half of #fragilestates in #Africa, 28% of population, 55% of people in these countries below #poverty line with significant negative impact on neighboring countries #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB: loss of state credibility or state services a major driver of fragility #fragilestates #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB: excluded #youth & sense of injustice another driver of #fragility #fragilestates #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB: #conflict & #fragility do not stop at political borders, so need for regional approaches to reduce #fragilestates #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB: regional political transformation needs to have positive economic results to be sustainable to reduce #fragilestates #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB: fragility trap in #Sahel with many children not in school, many teachers unemployed #fragilestates #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB: #genderequity through integrated approaches: promoting human capacity for women #education, social protection to keep girls in school, reproductive #health services #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB: many think that #DigitalAfrica should not be a priority, but #futureofwork is digital with internet access, not talking about turning every African into Bill Gates #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB had to go to #Mali to see a #3DPrinter, an entrepreneur creating prosthetics #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Albert Zeufack: global reasons for sluggish growth include trade conflict & resources prices #AfricaSOR #WBGmeetings pic.twitter.com/6QQpZwNfye

— Doug Hadden (@dalytics) April 13, 2019

Albert Zeufack discusses macroeconomic analysis in latest Africa Pulse that shows disappointing results https://t.co/6s8negFJ5i #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

The #digitalrevolution, if fully embraced, could add 2% of growth and reduce poverty by 1%. @WorldBankAfrica is investing in closing the #digital gap to achieve this digital dividend, says @AlbertZeufack https://t.co/nmypVzcMR4 #AfricaSOR pic.twitter.com/4F4g10dNtl

— World Bank Africa (@WorldBankAfrica) April 13, 2019

Albert Zeufack: within disappointing results in #Africa growth are countries like #Rwanda who have escaped #fragility #AfricaSOR #WBGmeetings pic.twitter.com/rW39XcnIdj

— Doug Hadden (@dalytics) April 13, 2019

.@SomaliPM: we need to get beyond the narrative of the #Somalia of the past, looking to #diaspora entrepreneurs, #youth, resources & strategic location for growth #AfricaSOR #WBGmeetings pic.twitter.com/Eh6FUTWxnf

— Doug Hadden (@dalytics) April 13, 2019

.@SomaliPM: investment in #Somalia critical but timing is the essence, with need to build growth in the region to create hope #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Aïchatou Boulama Kané: countries in #Sahel need to work together to create regional #security, progress has been made, also need to address #governance #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Alamine Ousmane Mey: we want to make #Africa the continent of the present not just the continent of the future #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Alamine Ousmane Mey: #Cameroon hosts 500,000 refugees #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Alamine Ousmane Mey: beyond security is social support & state enablement where people can participate in country growth #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@NanaDagadu: sexual & reproductive #health has had impact for overcoming #fragility & addressing fragile conditions across life transition points & improving #gender enabling environments #fragilestates #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@JulieGichuru: how do we address social context to convince men that #genderequity is not a threat? (Rather, leveraging latent human capital for growth) #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Aïchatou Boulama Kané: in #Niger, need to bring those out of the system into the system #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Aïchatou Boulama Kané: we have women in the region who are grandparents at the age of 30 #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@JulieGichuru: notion of marrying daughters off before completing #education is not just a rural situation in #Africa #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@SomaliPM: not leveraging women, half the population, is like running the country on half an engine #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Alamine Ousmane Mey hasn’t seen a bird flying high and fast with one wing, clear role for women, need to overcome cultural & religious obstacles #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

.@HafezGhanem_WB has been pleasantly surprised by positive reaction to #genderequity among African leaders, but can’t expect top-down to work by itself #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Albert Zeufack: gender economics is good #economics #AfricaSOR #WBGmeetings

— Doug Hadden (@dalytics) April 13, 2019

Digital transformation, investment in infrastructure, social inclusion will help in the fight against fragility across the Africa region, so will sexual and reproductive health education! @NanaApenemDagadu@AïchatouBoulamaKané#AfricaSOR #WorldBankAfrica

— Recheal Blankson (@RechealBlankson) April 13, 2019

Holistic, approaches are key. Sexual and reproductive health programs promote healthy #women and healthy communities, which can help prevent #conflict and #fragility. – @nanadagadu, Advisor, M & E/Reproductive Health at @SavetheChildren https://t.co/nmypVzcMR4 #AfricaSOR pic.twitter.com/Ba4P6tmsVg

— World Bank Africa (@WorldBankAfrica) April 13, 2019

Our girls exhibit all the best attributes to contribute to transformation more than society allows them to. We must look at gender equality to push forward. It is vital to empower women to be part of the decision making circles- Albert Zeufack @WorldBankAfrica #AfricaSOR

— #UgandaCAN 🇺🇬 (@DeeGash143) April 13, 2019

Chief Economists Roundtable: Income Inequality Matters: How to Ensure Economic Growth Benefits the Many and Not the Few

The Chief Economists presented some interesting observation about strengthening institutions, equity and trust for economic growth:

“This is the first time in history that the chief economists of the @WorldBank @OECD and @IMF are all women” – @Lagarde at #InequalityMatters #SpringMeetings pic.twitter.com/CkfoSCyleL

— Aditi Bhowmick (@AditiBhowmick18) April 13, 2019

Inequality of opportunities based on gender, economic circumstances, geography etc. reduces person’s potential to succeed in life. #InequalityMatters #SpringMeeting2019 pic.twitter.com/GJGD89bjK0

— Marja Nykänen (@MarjaNykanen) April 13, 2019

@Penny_WB pours doubt on the idea that retraining works to help those disadvantaged by free trade and globalization. A big issue throughout the developed West and rust belt phenomenon #InequalityMatters

— Bessma Momani (@b_momani) April 13, 2019

Some good news: 1.We should be happy with the fact that global inequality between states is in decline. 2. Focusing on gender inequality is finally mainstream. #InequalityMatters pic.twitter.com/b5oQ6j4Ss9

— Bessma Momani (@b_momani) April 13, 2019

Boosting Investment in People and Infrastructure

Primary focus of this session were the financing and infrastructure gaps. Takeaways included:

- Improved revenue mobilization can be achieved through transparency and anti-corruption, aided by digital technologies although it’s unclear how long it takes to achieve material results

- The lack of infrastructure isn’t limited to developing countries, infrastructure spending in advanced economies has dropped, and much of the existing infrastructure is crumbling

- The Public Investment Management Assessment (PIMA) tool has been used effectively in advanced and emerging economies

- Planning and execution performance is mixed with many governments witnesses significant delays and cost overruns for infrastructure

- Capacity building is needed in many countries, particularly at the sub-national level

.@gilliantett: #infrastructure development critical for #sustainability #inclusivity & driving digital revolution yet countries have high #debt burdens #FiscalForum #IMFmeetings pic.twitter.com/5rBPsx6rQO

— Doug Hadden (@dalytics) April 14, 2019

.@ Lagarde: significant drop in #publicinvestment in advanced economies, need for people focus in #emergingeconomies #FiscalForum #IMFmeetings pic.twitter.com/QzPwjblksb

— Doug Hadden (@dalytics) April 14, 2019

.@ Lagarde: describes the #PIMA toolkit to help countries manage #publicinvestment #FiscalForum #IMFmeetings https://t.co/fILtYGXmJE

— Doug Hadden (@dalytics) April 14, 2019

.@ Lagarde: 1.7% of #GDP investments in advanced countries is on the low side, have to recognize that hard #infrastructure can get private investment while soft like #education is unlikely #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@nicodujovne: #Argentina #infrastructure was depleted, #publicinvestment deficit is in $ Trillions while there is huge available financing where only a small portion goes to infrastructure, so need new financing instruments #FiscalForum #IMFmeetings pic.twitter.com/JQht9hCvyf

— Doug Hadden (@dalytics) April 14, 2019

Gloria Alonso: #Colombia has reduced poverty by about 20%, yet 3.5 million still in extreme #poverty, & demographic changes represents challenge where part of the solution is more effective spending and budgeting #FiscalForum #IMFmeetings pic.twitter.com/3O3f6JBLtR

— Doug Hadden (@dalytics) April 14, 2019

Gloria Alonso: #Colombia looking for #infrastructure spending at 8% GDP with focus on dealing with rural-urban divide #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

Gloria Alonso: #Colombia needs to integrate central & regional government budgets #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@Paschald: describes #Ireland2040 rationale including demographics, longer term approach to #publicinvestments to give certainty to the private sector #FiscalForum #IMFmeetings https://t.co/FjSgy1sTQ6

— Doug Hadden (@dalytics) April 14, 2019

.@Paschald: #Ireland finding ways to collaborate with private sector for #innovation #FiscalForum #IMFmeetings pic.twitter.com/Z8rAzqW3Lr

— Doug Hadden (@dalytics) April 14, 2019

Sharply cutting back on capital expenditure during a crisis creates problems after the crisis— @Paschald, Minister for Finance & Public Expenditure and Reform of Ireland. #FiscalForum pic.twitter.com/eYZVvaWUwJ

— IMFLive (@IMFLive) April 14, 2019

.@SongweVera: #SDGs provides a #publicinvestment framework, where there are $ billions in yearly #Africa gaps in meeting SDGs where lower income countries more challenged #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@SongweVera: digital technology can help improve revenue with #tax reform , in the order of $400B #FiscalForum #IMFmeetings pic.twitter.com/6bifTi166G

— Doug Hadden (@dalytics) April 14, 2019

The good news is we can do better in Africa if we raise tax revenues by increasing the tax base through the use of new technologies— .@SongweVera Executive Secretary of the UN @ECA_OFFICIAL #FiscalForum pic.twitter.com/1ujkPwTohi

— IMFLive (@IMFLive) April 14, 2019

.@SongweVera: lots of domestic savings including #Africa pension funds that have not been mobilized #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@nicodujovne: impediments to private investment #infrastructure incl lack of bankable projects, lack of standards, poor data, difficult to handle long term risk when working with local currencies #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@Paschald: currently making financing modality decisions on a case-by-case basis #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@Paschald: need to develop policy certainly beyond elections to encourage investment #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@Paschald: #Ireland lessons include cutting back on capital expenditures after a crisis creates more problems after, especially for #inclusivity & need to maintain spending effectiveness when ramping up #publicinvestments #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

Gloria Alonso: #Colombia has been working on creating certainty through #fiscalrules, regulatory reforms #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

Gloria Alonso: external #audits are important but internal audit more important because it’s looking when processes in movement #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

Gloria Alonso: critical to build capacity at sub national level in #Colombia to protect public money #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

Gloria Alonso: need to build a tax paying culture through building credibility in spending #transparency & effectiveness #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@gilliantett has seen figures suggesting that 1/3 of #Africa #infrastructure spending is wasted #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@SongweVera sees significant improvements in government #infrastructure #procurement & #anticorruption – need for internal #audit & #transparency on project execution #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@SongweVera: should have #transparency by default #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@SongweVera: needs to be #accountability & integrity from foreign private firms #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@nicodujovne: public private partnerships #PPPs need to be used wisely, coordinated, standardized, cost analyzed #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@Lagarde: Public investment in advanced economies – 1.7% of GDP as a global average at the moment. #FiscalForum https://t.co/h8dLc0vfTv pic.twitter.com/ET0EcFtMS7

— IMFLive (@IMFLive) April 14, 2019

.@nicodujovne: #transportation #infrastructure public investments focused on reducing commute times (has significant economic value-add for citizens) #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@ Lagarde: #PIMA tool has been effectively used in countries as diverse as #Ireland & #Ghana #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@ Lagarde: many countries get mesmerized by new technology when there needs to be a foundation of old technology in order to work #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@ Lagarde: economic interoperability and free trade in #Africa will facilitate business flows #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@ Lagarde: twice as much waste of resources between most corrupt & least corrupt countries #corruption #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@Paschald: new projects are very exciting but #infrastructure maintenance as important where #PPPs can play major role #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

The wise use of public-private partnerships is an important tool to help renew our infrastructure and bring down our fiscal deficit — Minister of Treasury, Argentina @NicoDujovne @Hacienda_Arg #FiscalForum https://t.co/h8dLc0vfTv pic.twitter.com/V6BTDzGpcw

— IMFLive (@IMFLive) April 14, 2019

.@Lagarde: beware of the large #whiteelephant projects like massive stadiums in urban areas rather than smaller projects like #agriculture #irrigation #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019

.@SongweVera: the #informal sector comes from high cost of formality, poor services from government so need to build business environment & demonstrate how taxes lead to business improvement #FiscalForum #IMFmeetings

— Doug Hadden (@dalytics) April 14, 2019